One of the most discussed subjects in the corporate environment in recent years is Compliance. Efforts to fight corruption in Brazil and in the world contribute to the dissemination of the area. However, there are still many doubts and an uncertainty about the scopes in the scope of risk management. To help you understand what Compliance is, in this article we have elaborated 6 key points on the topic.

1 – The origin of compliance

The compliance etymology has two ramifications. In a line, it originates in the word complir (comply) of the old French. In Latin, however, there is a connection with complere (perform). With these origins, the English word compliance means agreement with what is requested. Similar meaning appears in compliant, one who agrees with something. The verb to comply (with) denotes the meanings of fulfilling, executing, being in conformity or attending to what is ordered.

To learn more about the origin of the activity, check out our Compliance in History series:

First phase: The germination of the area

Second phase: The birth of the area

Third phase: Money laundering era

Fourth phase: Age of fraud and stricter laws

Fifth phase: Golden age of the fight against corruption in Brazil

2 – Compliance variations

Based on these introductory meanings, compliance programs or systems are presented. Some variations can be found in the literature on the topic, such as compliance programs or systems, in Spanish-speaking countries, or compliance, compliance or integrity programs, in Portuguese-speaking nations. This last term is the one chosen by the Brazilian legislation (DE CARLI, 2016). In turn, the United Nations opts for an anti-corruption program.

3 – Definition of compliance

Regardless of the terminology adopted, they all deal with the same theme. In the book Compliance 360º, the specialist in Corporate Governance by IBGC, Ana Paula Candeloro, defines Compliance as follows:

“[…] A set of rules, standards, ethical and legal procedures that, once defined and implemented, will be the main line that will guide the institution’s behavior in the market in which it operates, as well as the attitudes of its employees” (CANDELORO , 2012, p. 30).

<iframe src=”https://player.vimeo.com/video/336121517?h=b928cfec1a” width=”640″ height=”360″ frameborder=”0″ allow=”autoplay; fullscreen; picture-in-picture” allowfullscreen></iframe>

<p><a href=”https://vimeo.com/336121517″>Compliance Week da Interact</a> from <a href=”https://vimeo.com/interact”>Interact Solutions</a> on <a href=”https://vimeo.com”>Vimeo</a>.</p>

4 – Where compliance is located

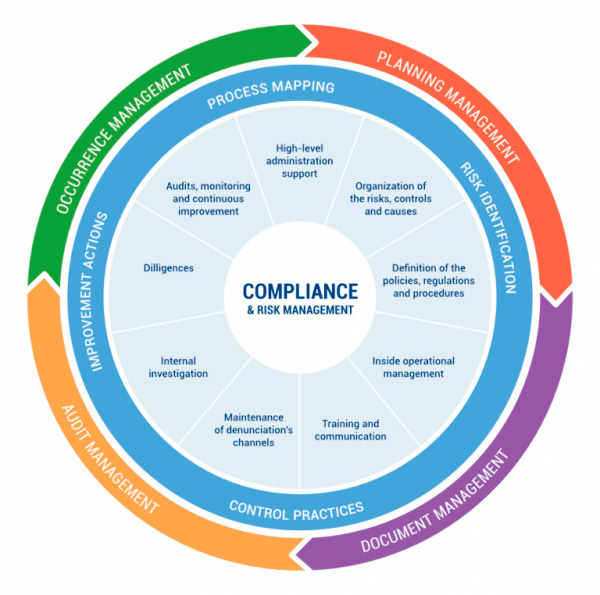

Compliance is within the scope of Corporate Governance, inserted within the sphere of Risk Management, where it has a central role. After all, it aims to integrate the cultural dimension of an organization through a routine approach. As functions, it seeks to establish the culture of conformity in an educational, preventive and corrective way. Next to it, the Internal Audit and External Audit areas appear on the organization chart.

5 – What are the roles and risks of compliance

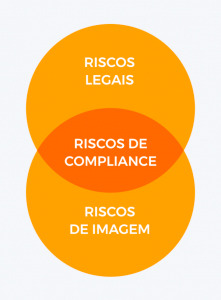

The implementation of a program seeks to mitigate compliance risks, which are the sum of legal risks and image risks. Strictly speaking, they do not necessarily have to be linked to each other. For example, a publication with inappropriate content on the company’s social networks can damage the image of the corporation, incurring an image risk, but not contemplating any harm with the law, that is, corresponding to a legal risk.

The implementation of a program seeks to mitigate compliance risks, which are the sum of legal risks and image risks. Strictly speaking, they do not necessarily have to be linked to each other. For example, a publication with inappropriate content on the company’s social networks can damage the image of the corporation, incurring an image risk, but not contemplating any harm with the law, that is, corresponding to a legal risk.

Along this line, the doctor of law from USP Leandro Sarcedo (2014, p. 8) argues that Compliance works as “a structure that verifies and validates the good functioning, correctness and reliability of management, preventing risks immanent to business activity” . In his view, the program aims to manage business risk, both by complying with the legal obligations of the company’s area of operation, and by monitoring and preventing initiatives in the opposite direction.

6 – Good compliance means good company

The current scope of Compliance goes beyond the borders of the territory of origin, the financial system. In the words of Marcia Ribeiro and Patrícia Diniz (2015, p. 88), “Compliance involves a strategic issue and applies to all types of organizations, since the market tends to demand more and more legal and ethical conduct for the consolidation of new behavior on the part of companies ”. In their reading, good corporations start to seek sustainable profitability, with a focus on economic and socio-environmental development in conducting business.

Discover Interact’s Compliance & Risk Management solution

Author:

Vinícius Flôres

Journalist, Ph.D. in Communication, and martech enthusiast. Communication and Marketing Supervisor at Interact Solutions.

References

CANDELORO, Ana Paula P. Compliance 360º: riscos, estratégias, conflitos e vaidades no mundo corporativo. São Paulo: Trevisan Editora Universitária, 2012.

DE CARLI, Carla Veríssimo. Anticorrupção e Compliance: a incapacidade da lei 12.846/2013 para motivar as empresas brasileiras à adoção de programas e medidas de Compliance. Tese de Doutorado – Programa de Pós-Graduação em Direito da Universidade Federal do Rio Grande do Sul. Porto Alegre, 2016.

RIBEIRO, Marcia Carla Pereira; DINIZ, Patrícia Dittrich Ferreira. Compliance e Lei Anticorrupção nas empresas. Revista Informação Legislativa. Ano 52, número 205, jan./mar. 2015. p.87-105

SARCEDO, Leandro. Compliance e Responsabilidade Penal da Pessoa Jurídica: Construção de um novo modelo de imputação, baseado na culpabilidade corporativa. Tese de Doutorado. Faculdade de Direito da Universidade de São Paulo, 2014.